tacoma sales tax calculator

We are your friendly neighborhood tax center with knowledgeable IRS-registered tax professionals. Tacoma is located within Pierce County Washington.

Washington Income Tax Calculator Smartasset

Lists of local sales use tax rates and changes as well as information for lodging sales motor vehicles sales or leases and annexations.

. Groceries are exempt from the Tacoma and Washington state sales taxes. Quarterly tax rates and changes. Sales Tax Calculator.

Fill in price either with or without sales tax. The state sales tax rate is the rate that is charged on tangible personal property and sometimes services across the state. Both Washington and Tacomas BO tax are calculated on the gross income from activities.

Deduction options for salon and barbershop owners. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. 1407 E 72nd St.

Download our Tax Rate Lookup App to find Washington sales tax rates on the go wherever your business takes you. Find list price and tax percentage. Here at Foothills Toyota our priority is to provide the best possible customer experience.

The Tacoma Washington sales tax is 1000 consisting of 650 Washington state sales tax and 350 Tacoma local sales taxesThe local sales tax consists of a 360 city sales tax. US Sales Tax Washington Pierce Sales Tax calculator Tacoma. We also specialize in health insurance.

Just tap to find the rate Local sales use tax. Sales Tax Calculator Foothills Toyota The second is a volume tax called the spirits liter tax which is equal to 37708 per liter retail or 24408 per liter restaurants and bars. If this rate has been updated locally please contact us and we.

The sales tax jurisdiction name is Pierce which may refer to a local government divisionYou can print a 103 sales tax table hereFor tax rates in other cities see Washington sales taxes by city and county. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

How much is sales tax in Tacoma in Washington. The County sales tax rate is. Then use this number in the multiplication process.

Did South Dakota v. Multiply the price of your item or service by the tax rate. These usually range from 4-7.

When searching your next new vehicle not only do we have a Toyota to fit every lifestyle but some of the best deals youll find in Washington. Decimal degrees between 450 and 49005 longitude. Sales tax in Tacoma Washington is currently 10.

A full list of locations can be found below. Use our local Tax rate lookup tool to search for rates at a specific address or area in Washington. Sales tax calculator tacoma wa Sunday February 27 2022 Edit Due to recent changes to the Tax law for 2018 the IRS encourages everyone to use the Withholding Calculator to perform a quick paycheck checkup The Calculator helps employees make sure they have the right amount of tax withheld from their paycheck at work and helps them determine.

The December 2020 total local sales tax rate was 10200. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. It is measured on the value of products gross proceeds of sales or gross income of the business.

You can find more tax rates and allowances for Tacoma and Washington in the 2022 Washington Tax Tables. The 103 sales tax rate in Tacoma consists of 65 Washington state sales tax and 38 Tacoma tax. Youll find rates for sales and use tax motor vehicle taxes and lodging tax.

The minimum combined 2022 sales tax rate for Tacoma Washington is. Download the latest list of location codes and tax rates. Tacoma in Washington has a tax rate of 10 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Tacoma totaling 35.

Thanks for stopping by. Wayfair Inc affect Washington. In some states the sales tax rate stops at the state level.

There is no applicable county tax or special tax. As far as sales tax goes the zip code with the highest sales tax is 98401 and the zip code with the lowest sales tax is 98433. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

Sales Tax Calculator Sales Tax Table. The Tacoma sales tax rate is. This is the total of state county and city sales tax rates.

There is base sales tax by Washington. Look up a tax rate on the go. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due.

Counties cities and districts impose their own local taxes. This level of accuracy is important when determining sales tax rates. See Inventory Get A Quote.

In Texas we have to charge the sales tax. Washington unlike many other states does not have an income tax. The sales tax rate for Tacoma was updated for the 2020 tax year this is the current sales tax rate we are using in the Tacoma Washington Sales Tax Comparison Calculator for 202223.

For example the state rate in New York is 4 while the state sales tax rate in Tennessee is 7. The current total local sales tax rate in Tacoma WA is 10300. Washington has a 65 statewide sales tax rate but also has 105 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2368 on.

Sign up for our notification service to get future sales use tax rate. How to Calculate Sales Tax. The City Business Occupation BO tax is a gross receipts tax.

Calculator for Sales Tax in the Tacoma. Within Tacoma there are around 31 zip codes with the most populous zip code being 98404. When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction.

The Tacoma Sales Tax is collected by the merchant on all qualifying sales made within Tacoma. You can print a 103 sales tax table here. The sales tax added to the original purchase price produces the total cost of the purchase.

The sales tax rate for Tacoma was updated for the 2020 tax year this is the current sales tax rate we are using in the Tacoma Washington Sales Tax Comparison Calculator for 202223. From there it can determine the corresponding sales tax rate by accessing AvaTax our innovative cloud-based sales tax calculation product. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

The results are rounded to two decimals. There is no applicable county tax or special tax. Our mobile app makes it easy to find the tax rate for your current location.

The Washington sales tax rate is currently. Divide tax percentage by 100 to get tax rate as a decimal. Automated Sales tax needs to be turned off - period.

Sales Tax By State Non Taxable Items Taxjar

8 5 Sales Tax Foothills Toyota

Sales Tax Calculator Foothills Toyota

2021 Toyota Tacoma Monthly Car Payment Calculator U S News World Report

Washington Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Sales Tax Calculator Foothills Toyota

Sales Tax Calculator Foothills Toyota

What Is The Washington State Vehicle Sales Tax

States With Highest And Lowest Sales Tax Rates

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

New Toyota Tacoma For Sale In Bremerton Wa

Five States Without Sales Tax Ramseysolutions Com

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Illinois Car Sales Tax Countryside Autobarn Volkswagen

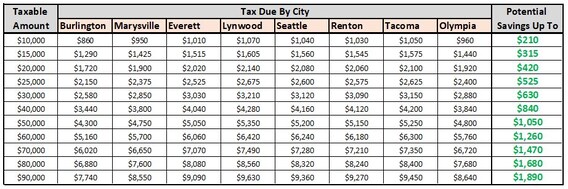

Auto Sales Tax Calculator Buy A Vw Near Marysville Wa